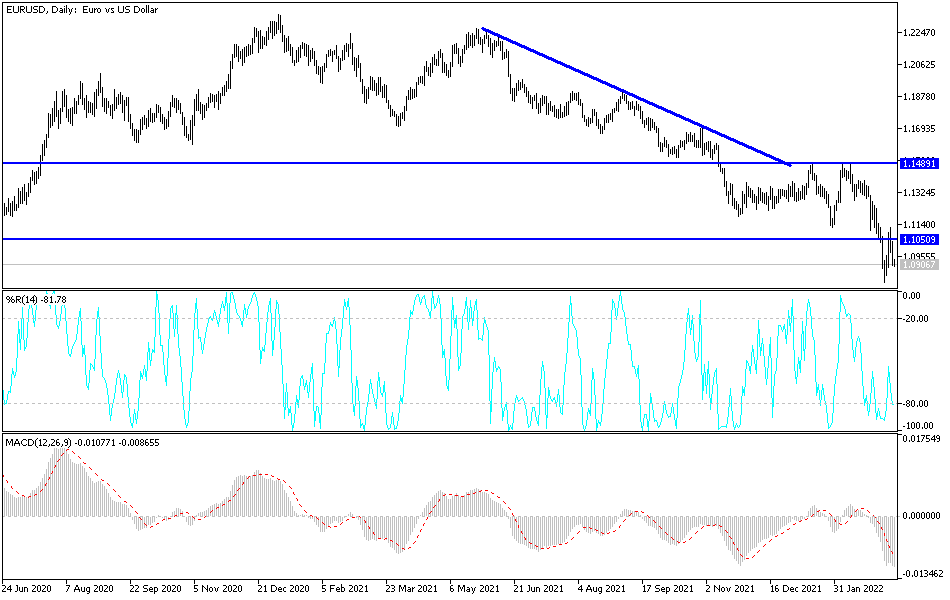

EUR/USD Technical Analysis: Strongest Downside Path

The price of the EUR/USD currency pair was not happy with the bullish rebound attempts last week.

It moved towards the resistance level of 1.1121 immediately after strong signals from the European Central Bank for the opportunity to raise interest rates closer than previously thought. At the end of the week’s trading, the EUR/USD pair collapsed in the same descending path, reaching the support level of 1.0902, which closed trading near it. As it is known that the euro is most negatively affected by the consequences of the Russian-Ukrainian war.

On the forecast, the EUR/USD pair could be in the process of creating an approximate trading range of 1.08 to 1.12 in the short term, according to analysts at Credit Suisse and TD Securities. The European single currency briefly broke above the 1.11 peak in the moments immediately following the European Central Bank additional “conditional” steps it might take to normalize its monetary policy settings over the coming months. The strong dollar was quickly overshadowed by the euro against the dollar, and not even lower oil prices were able to stop it from rebounding lower on Friday. The tepid increase in the price of oil may have also weighed on the euro in the last session of the week.

Before the ongoing Russian invasion of Ukraine, the correlation between the single European currency the euro and the oil price was positive, meaning that they were mostly moving in the same direction. However, the overlapping increase in energy costs is an outright headwind to economic growth that will also cause more currency to sell off in the market against the US dollar, meaning that recent developments in commodity prices are a double burden for the single European currency.

Thursday’s policy decision saw the European Central Bank bring forward June, from October, when the asset purchase program will reduce its monthly purchases of government bonds to €20 billion, and formally acknowledge that interest rates may rise in the near future. However, it is all about the ECB’s policy prospects being very “conditional” on how the Eurozone economy will perform over the coming months. In the meantime, the Fed is widely expected to raise its own interest rate on what could be multiple occasions.

According to the technical analysis of the pair: The general trend of the EUR/USD currency pair is still bearish, and the opportunity to move towards the psychological support 1.0800. Below it remains as long as the Russian war and its negative repercussions on the path of economic recovery in the eurozone. Accordingly, the gains of the Euro-dollar will remain, as I mentioned before, an opportunity to sell, and the closest targets for the bulls are 1.0985, 1.1065 and 1.1130, respectively.

Today is very calm in terms of influential economic data, and the greatest interest will be the reaction of investors and markets to the development of the Russian-Ukrainian war.

Source link