War on Cash Warning: Canada’s Major Banks Mysteriously Go Offline

What would you do if you went to the ATM and found that you couldn’t access the money in your bank account?

Many Canadians recently suffered this unsettling experience. Customers of five major Canadian banks reported mysterious online banking outages last week after Canadian Prime Minister Justin Trudeau announced he was invoking emergency powers in response to a massive trucker protest. This gave the Canadian government the authority to freeze bank accounts.

Under the Emergencies Act, the Canadian government authorized banks and financial institutions to “temporarily cease providing financial services where the institution suspects that an account is being used to further the illegal blockades and occupations.”

As ZeroHedge reported, Royal Bank of Canada (RBC), BMO (Bank of Montreal), Scotiabank, TD Bank Canada, and the Canadian Imperial Bank of Commerce (CIBC) were all hit with unexplainable outages the evening of Feb. 16.

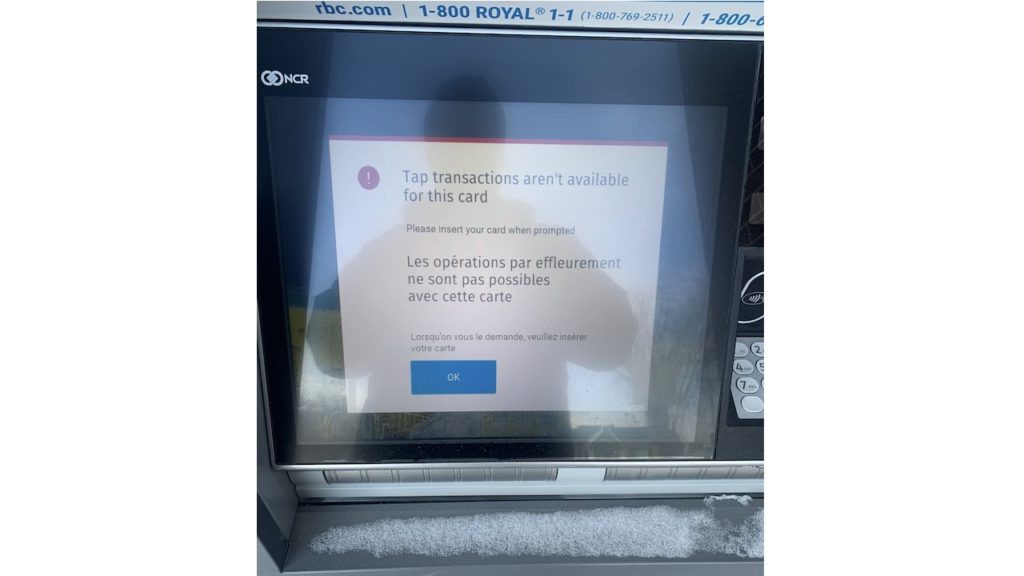

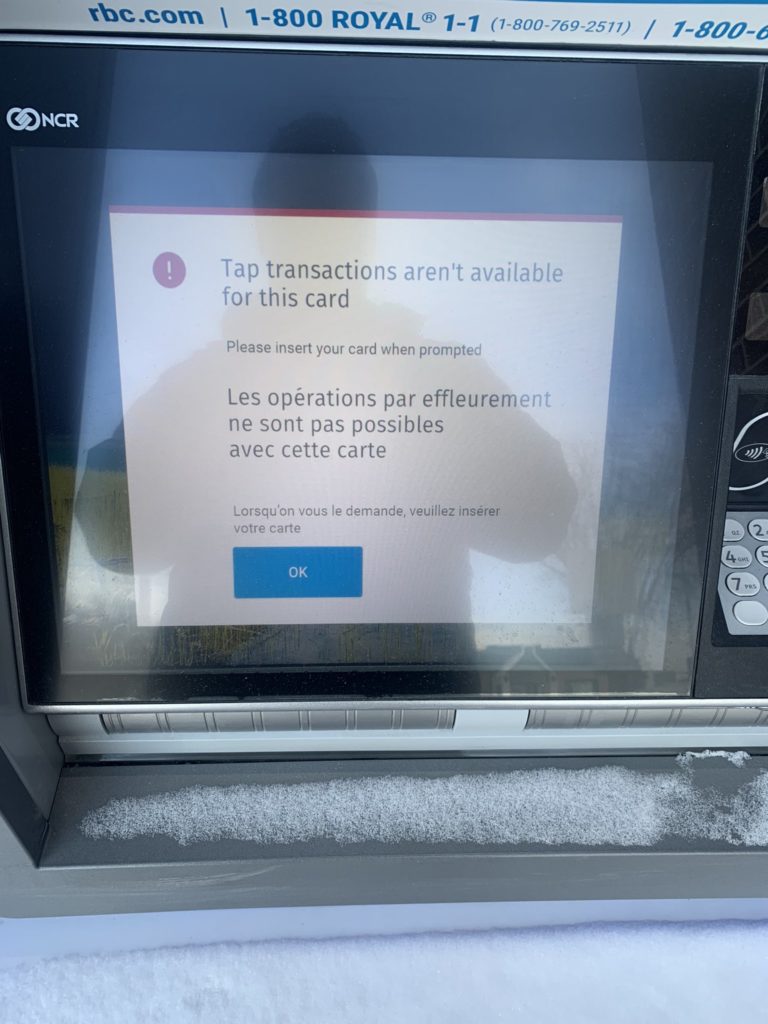

Twitter users in Canada reported that they couldn’t access funds at ATMs.

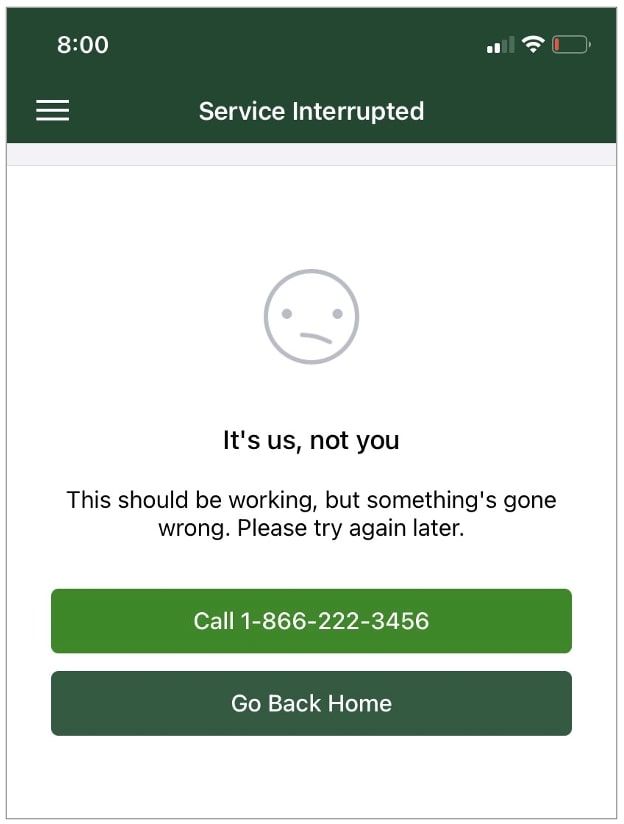

Users also reported the inability to access e-Transfers, along with online and mobile banking services.

@RBC I have no access to my money at the grocery store, come to find out there’s a nationwide RBC outage affecting my accounts. What’s going on here? I been waiting at the checkout line for 30 minutes hoping it will work, I’m gonna have to leave because now I have no money

— Andrew Currie (@EHSEA902) February 16, 2022

RBC tweeted, “We are currently experiencing technical issues with our online and mobile banking, as well as our phone systems.”

Our experts are investigating and working to get this fixed as quickly as possible, but we have no ETA to provide at this time. We appreciate your patience.”

Other banks simply denied there was a problem. A TD Bank spokesperson told BleepingComputer that the bank wasn’t experiencing any widespread system outage or issue.

It remains unclear what caused the outages, but it’s not a stretch to assume that it was somehow related to the government’s pronouncement.

After Trudeau announced the invocation of emergency powers, Google searches for the term “bank run” spiked in Canada.

This should serve as a warning.

The War on Cash

We’ve been reporting on the “war on cash” for years. This refers to moves by governments to limit or even eliminate physical cash and currency. Fundamentally, it’s about control. The elimination of cash creates the potential for the government to track and even control or block consumer spending,

Governments around the world have quietly waged a war on cash for years. Back in 2017, the IMF published a creepy paper offering governments suggestions on how to move toward a cashless society even in the face of strong public opposition.

Governments sell cashlessness as more convenient. We’re also told it will help stop dangerous criminals who like the intractability of cash.

But imagine if there was no cash. It would be impossible to hide even the smallest transaction from government eyes. Something as simple as your morning trip to Starbucks wouldn’t be a secret from government officials. And as we saw in Canada, governments can easily shut off your access to your bank accounts. If you have cash, you can still buy and sell even if the banking system is down. Without cash, you are at the mercy of the government.

It remains unclear if the outages in Canada were related to the Emergencies Act. Regardless, cash shortages caused by government policy aren’t mere paranoid speculation.

Indians faced a major shortage of cash in 2017 with as many as 90% of ATMs in some regions of the country running completely out of currency. The cash crisis stemmed from a policy of demonetization the Indian government launched in late 2016.

That wasn’t the first time people faced cash shortages due to government policy. Greeks had their access to cash severely restricted during their country’s recent economic turmoil. It got so bad, a robust barter economy developed out of sheer necessity, as everyday Greeks had to find ways to cope with cash withdrawal limits and currency shortages.

In fact, developing local networks to facilitate barter provides on way to shield yourself from cash shortages.

You can establish barter relationships in your own community – now – before a banking or currency crisis creates chaos. The SchiffGold Barter Metals page provides information on how to get started, and how to find people in your area willing to trade goods and services for gold or silver. If you develop these relationships now, you will have a considerable advantage in the event of a financial meltdown.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link