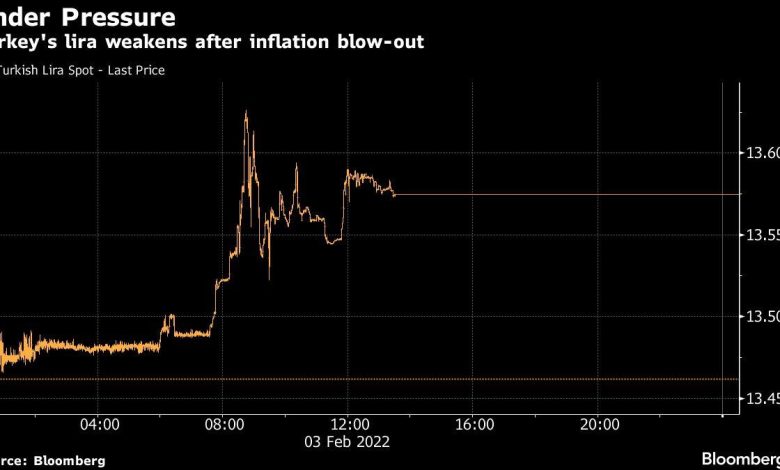

Turkey’s Real Rate at Minus 35% Deepens the Gloom for Lira

(Bloomberg) — A real rate of minus 35% and little prospect of a rate hike by the Turkish central bank can only mean more losses for the beleaguered lira.

Most Read from Bloomberg

Traders see a probability of almost 50% that the lira will surpass its record low of 18.3633 per dollar by the end of the year, according to Bloomberg calculations based on prices of put and call options. The currency slumped as much as 1.2% Thursday before paring its drop to trade at 13.5772 as of 2:08 p.m. in Istanbul.

Under pressure from President Recep Tayyip Erdogan, the central bank has slashed interest rates by 500 basis points since September — at a time when policy makers in other developing economies are tightening to rein in prices. With the worst real rate in emerging markets, the lira is likely the most vulnerable to any bout of risk aversion as the Federal Reserve prepares to raise interest rates.

“The lira is the least attractive EM currency due to deeply negative real interest rates in a global environment dominated by a growing tendency to raise interest rates in response to rapidly rising inflation,” said Piotr Matys, a senior currency strategist at InTouch Capital Markets Ltd. in London.

Turkey’s consumer-price inflation surged an annual 48.7% in January, leaving the central bank in a quandary. While lifting borrowing costs will anger Erdogan, a self-described “enemy of interest rates,” cutting or even holding them will only add to runaway price increases. Erdogan replaced the head of the country’s statistics agency last week amid political debates over the reliability of key economic reports.

The lira has found a floor around 14 per dollar in the past six weeks after the central bank and state lenders intervened in December, and the government introduced a program that seeks to convince retail investors to shift their savings into the local currency. Still, it’s one of the worst performers in emerging markets this year after losing almost half its value in 2021.

“Admittedly, the lira has been relatively stable over the last few weeks, but it’s unlikely to last as long as the experiment in monetary policy continues,” InTouch’s Matys said.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link