The US mint sells five million silver eagle coins in January

-

The dollar gives back some of its gains on Monday.

-

Chuck plays Jeopardy, with readers.

Good Day… And a Tom Terrific Tuesday to you! And… Welcome to February! I normally don’t mind February too much, especially now that I spend my winters down south… It is a couple of days shorter, and then it’ll be March! Not to push time ahead, just looking ahead… Well, today, guys, you have 13 more days to secure your sweetheart, or mother, or whatever, your best guess at Valentine’s Day present! You’ve been warned! You don’t want to mess this up guys! Well, it’s Bengals and Rams in the Super Bowl… I said at the beginning of the playoffs that I wouldn’t want to be the team that drew the Bengals… That proved to be bang on! So, I’ll stick with the Bengals, the Good Lord knows I can’t root for the Rams! They left me, so I left them! Peter Gabriel greets me this morning with his song: Sledgehammer!

Well, most markets took a breather yesterday, after last week’s most bizarre trading I had ever seen. The dollar did not take a breather and lost some ground that it had gained last week, about 1-cent to the euro, and Aussie dollar and the other currencies fell in to grab their own gains… Gold gained $5 on the day to close at $1,797.50, while Silver lost a whopping 3-cents on the day at closed at $22.53.

There were no data prints, to speak of, to cause the dollar to lose so much in one day, but, from my view in the cheap seats, this was just a correction of the overbought situation last week for the dollar… The dollar was bought last week with no regard to what the real fundamentals were telling us and how the dollar should be getting sold…

In the overnight markets last night… There was more dollar selling, and at this point we’re about to get back to where the dollar was pre-last week… These are strange days indeed! The BBDXY this morning is 1,179.58. recall from above that it closed last night at 1,183.37… Gold is up $12 in the early trading today, and Silver which has really disappointed holders of the metal lately, is up 54-cents to start the day, and it is back over $23.00.

Speaking of Silver… The U.S. Mint reported yesterday that they had sold 5 Million Silver Eagles in January! And the price of Silver went down in January? Bizarre, simply bizarre folks… I don’t know about you, but to me, Silver is biding its time before taking off to higher ground… Well, at least that’s my story and I’m sticking to it!

Timing on such a move to higher ground? Well, I’m not one to say, “On this particular day the market will crash” or something like that… But will I will do is to say that sometime after the Fed/ Cabal/ Cartel hikes rates the first time in March… I say that because to me, the markets will get the feeling of “too little, too late” when the Central Bank hikes rates only 25 Basis Points (1/4%)… And they will begin to look for hedges, earnestly… And that’s when the move to higher ground for Silver and Gold will occur… In my mind that is… of course I could be wrong about that, so we’ll see, eh?

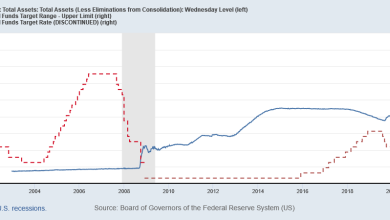

Well, I’m expecting a delivery today of a book, and not my usual Stuart Woods, Stone Barrington books… This is a brand new book titled: The Lords of Easy Money: How the Federal Reserve Broke the American Economy…. Since I write about this stuff all the time and have basically blamed the Fed for allowing, oh never mind, you all know… The reason I purchased the book was to see if there was something in it that I missed along the way…

OK, back to the markets… The price of Oil, after a brief selloff last week, has been busy getting back to the rally tracks and trade last night with an $88 handle… $4, $5 gas by the summer seems to be in the cards here folks… Inflation, inflation, inflation… Everywhere we go… I saw that Kathy paid $15 for a 1.25 LB of deli turkey yesterday! You know, I could be like the Fed and just substitute something else when something gets to costly… Instead of eating turkey each day for lunch, I could eat…. Ah, forget about it! I’m not going to substitute anything! That’s hard work, and I’m retired! HAHAHAHA

The 10-year Treasury’s yield was stuck in the mud yesterday, and didn’t move off of 1.78% all day… So, except for the dollar that gave back some of last week’s gains, Everything else was stuck in the mud and not moving strongly either way…

In the overnight markets, the 10-year yield dropped to 1.74%, so there was some buying of the bond overseas, apparently… Hmmm…

OK… Did you hear the news that the Fed/ Cabal/Cartel New York, the only Fed regional bank that has its own trading floor, has opened another trading floor in the same building as the Chicago Futures market… Ok, on the outside you say, so what, right? Well, upon further review we come across this from the folks at Wallstreetonparade.com

“Why is that a bombshell? Because it suggests to Wall Street savvy readers that the New York Fed may be planning to use the futures markets to try to engineer a soft landing in an attempt to get itself out of the very serious mess it’s made that Leonard explains very convincingly throughout his book.”

Oh, those silly little boys and girls at the Fed/Cabal/Cartel always keeping us guessing… and playing games with us… Isn’t it fun? NO!

The top ten Gold producers for 2021 were announced yesterday, and of course China is number 1, Australia is #2, Russia is #3, and guess who was #4? Come on… cue the Jeopardy music… Ok, if your answer was Who is the U.S.? Then you win final Jeopardy, what did you wager?

The Top Ten producers in Silver were also announced and this group is quite interesting as I was unaware that some of these countries were even a player in the pool… Here’s the Top Ten… Mexico, China, Peru, Chile, Russia, Poland, Australia, Bolivia, U.S., Argentina… Now that’s quite an interesting group isn’t it?

The U.S. Data Cupboard today will confirm that we as a country, still have over 10 Million job openings, and over 4 Million jobs quits last month… Seriously, we’ve got to solve for these two data pieces… That’s too many job openings, and too many people quitting jobs each month… The January ISM (manufacturing index) will print also print today, and while the monthly drops have been small, this data has shown a monthly drop in the index numbers for a few months in a row now, and that to me equals a trend… The index will remain above 50 at 57, but it is falling…

To recap… The dollar got sold yesterday and gave back about 1-cent of its gains last week to the euro and other currencies. Gold rose by $5, and Silver lost 3-cents… Bonds didn’t move, and the price of Oil bumped higher to an $88 handle. The Fed/ Cabal/ Cartel is up to dirty tricks again, and are opening another trading floor next to the futures exchange… And Chuck thinks that they are up to no good… as usual! In the overnight markets last night….

For What It’s Worth… Well, once again, I was searching high and low for articles for this section, and finally settled on this one that I saw in Ed Steer’s letter this morning… This is about the media, and what we should use TV for, and it can be found here: The Need for Information Filtration – Doug Casey’s International Man

Or, here’s your snippet: “In generations past, information was provided by word of mouth, or through reading, either in a book, a letter or a periodical. It was a slow system, but it did have an advantage: information came in one item at a time, and people had an opportunity to chew on the new bit of information for a while and consider whether to accept it or not.

Today, though, we are bombarded with information. The internet certainly has been an incredible boon, as it serves as book, periodical, and mail service all in one, and has the advantage of being immediate. Television is another animal entirely.

Television provides information continually, and we have only limited control over what we receive from it. In addition, in recent years, it has become a means through which to indoctrinate viewers with propaganda. For example, a conservative-thinking viewer may feel that he is in control if he selects, say, Fox News instead of the network news that he considers to be biased toward the liberal-thinking networks. He may or may not notice that, in the bargain, whatever good points the left has to offer are missing from Fox – many liberals that are allowed on Fox are those who are hopelessly inept and, not surprisingly, get roundly trampled by the Fox hosts (thereby reinforcing the conservative view). Additionally, information regarding libertarians such as Ron Paul is frozen out almost entirely.

Should we then avoid television news? Possibly so, but it does have its use. It alerts us as to current events. The trick is to use it as an “alert” service while keeping clear of the dogma that it feeds us.”

Chuck Again… Well, I know that I rarely, watch TV news… And I mean rarely, because I got tired of them telling me what I should think about something! And the TV news has gone to panels to discuss things, this drives me batty! So… I’ve already limited my exposure to these mind-shaping telecasts…

Market Prices 2/1/2022: American Style: A$ .7106, kiwi .6615, C$ .7881, euro 1.1267, sterling 1.3491, Swiss $1.0858, European Style: rand 15.2220, krone 8.8324, SEK 9.2641, forint 316.00, zloty 4.0639, koruna 21.5906, RUB 76.65, yen 114.62, sing 1.3490, HKD 7.7955, INR 74.72, China 6.3612, peso 20.51, BRL 5.2755, BBDXY 1,179.58, Dollar Index 96.30, Oil $87.59, 10-year 1.74%, Silver $23.07, Platinum $1,054.00, Palladium $2,480.00, Copper $4.40, and Gold… $1,810.50.

That’s it for today… A little shorter than usual, but still full of the only financial news you’ll ever need to know! HA! And you don’t need to worry, for I’ll never give in to the “man”… Tomorrow is Ground Hog Day, and every year I think of two things on that day… 1. The movie Groundhog Day, with Andie McDowell, and 2. A young lady that worked for me back in the 80’s by the name of Kate, used to be all about Groundhog Day, and she would through a big shindig every year on the day… That was 40 years ago! Now that’s crazy stuff for me even to remember that! The Baseball Owners and Players’ Union are talking, and ironing out some things, but they had better get into gear because they’ve got the same 13 days that you have to buy a Valentine’s Day gift to get this deal donw, and have Spring Training start on time! And if you’ve been with me all these years, you know that I’m all about Spring Training! Elvin Bishop takes us to the finish line today with his song: Fooled Around And Fell in Love… I hope you hae a Tom Terrific Tuesday today, and Please Be Good To Yourself! Be Positive, Test negative!

Source link