Jittery Investors Moving Money into Gold for Protection

Gold futures are edging higher on Thursday after Russian-controlled media agency RIA claimed that Ukrainian forces had shelled territory held by pro-Russian separatists. The news drove down riskier assets as investors sought shelter in the so-called safe-haven asset.

After the initial surge in prices, gold retreated after Ukraine denied the Russian report that it launched shells in eastern Ukraine, and accused Moscow-backed rebels of attacking a village in the region.

Nonetheless, global investors remained jittery, helping to put a bid under gold.

At 13:07 GMT, April Comex gold futures are trading $1890.00, up $18.50 or +0.99%. On Wednesday, the SPDR Gold Shares ETF (GLD) settled at $174.84, up $1.76 or +1.02%.

Traders Focused on Ukraine-Russia Crisis

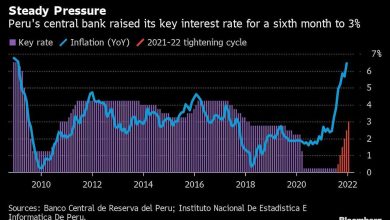

Worries over inflation and aggressive central bank tightening appear to be taking a backseat to the situation in Eastern Europe, where Western government officials continue to warn Russia about the substantial cost it will incur if it invades Ukraine.

Unfortunately, all traders have are the headlines, which could be the source of heightened volatility over the near-term.

Headline trading is risky because with every bullish headline, traders can expect a bearish one to follow. Furthermore, every news service, every country involved has an agenda so one can never really tell if they are trading the truth.

Take for example this piece of intelligence. According to Reuters, the U.S. warned that Moscow could use false claims about the conflict as a pretext for an invasion of Ukraine. Meanwhile, the Russians said essentially the same think about the U.S.

Although gold is in an uptrend, the move has been labored. Perhaps we’ll see an actual spike to the upside if the situation escalates into a war. Until then, the jaw-boning between Washington and Moscow is likely to continue to lead to a cautious trade.

Short-Term Outlook

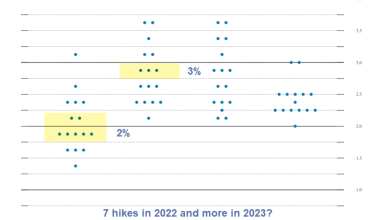

Yesterday’s Fed meeting minutes reiterated the central bank’s plans to begin raising rates in March. No surprise there. It didn’t matter anyway to gold traders, who have already priced in the rate hikes, but would prefer to play the long side until they see evidence that inflation is coming down, which could take months.

Meanwhile, the market is likely to remain bid until the Russian military build-up shows actual signs of subsiding. The latest reports show that there has been no evidence of Russian forces leaving the Ukrainian border with intelligence suggesting that Moscow was in fact building up more troops and equipment close to Ukraine.

Source link