Hungary to Hike Again on Inflation Overshoot: Decision Guide

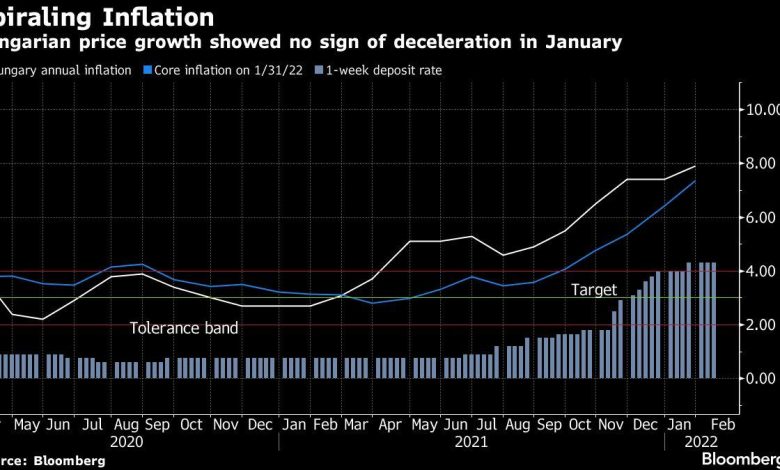

(Bloomberg) — Hungary’s central bank will continue raising interest rates after government-imposed price caps on everything from food to fuel failed to slow inflation.

Most Read from Bloomberg

Policy makers will probably raise the base rate 50 basis points to 3.4% on Tuesday, according to 16 of 18 economists in a Bloomberg survey, matching the size of January’s increase for the eighth consecutive monthly hike. The decision will be announced at 2 p.m. in Budapest, followed by a statement an hour later. Deputy Governor Barnabas Virag will also hold a briefing from 3 p.m.

The base rate has been supplanted by the central bank’s 1-week deposit facility as the effective key rate. The latter is currently 4.3%, and economists in a Bloomberg survey expect it to rise by 30 basis points on Thursday, in line with a central bank pledge to align the two instruments in the first half of the year.

Inflation surged to an annual rate of 7.9% in January, an almost 15-year high, as pandemic-related supply disruptions and record pre-election spending by Prime Minister Viktor Orban’s government fueled price growth.

Inflation has also become an issue for voters, prompting Orban to freeze mortgage rates and cap prices for some staple foods and fuel, in addition to household utility bills that have been subsidized for years.

(Updates with Deputy Governor’s briefing in second paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link