Global companies slow debt-raising as yields climb

Stock index price for France’s CAC 40 and company stock price information are displayed on screens as they hang above the Paris stock exchange, operated by Euronext NV, in La Defense business district in Paris, France, December 14, 2016. REUTERS/Benoit Tessier/File Photo

Register now for FREE unlimited access to Reuters.com

Register

Feb 16 (Reuters) – Global non-financial companies have issued the lowest debt volumes in three years in the first six weeks of 2022, deterred by rising interest rates as governments start scaling back their pandemic-era stimulus assistance.

According to Refinitiv data, global non-financial companies have raised $207 billion between Jan 1. and Feb. 12, the lowest amount borrowed in that period since 2019. That compares with $318 billion collected in the last year.

The data includes high yield, investment grade and emerging market bonds issued by public and private companies in both local and foreign currencies

Register now for FREE unlimited access to Reuters.com

Register

“In anticipation of the Federal Reserve tapering and initiating rate increases in March, market interest rates have already begun moving higher, increasing borrowing costs,” said Jeff Bryden, portfolio manager at RMB Capital.

“Adding to these factors is the uncertainty and impact on economic growth that will accompany higher rates.”

The energy sector led this year’s borrowing, issuing $46.6 billion worth, while companies in the industrial and real estate sectors raised $42.2 billion and $28 billion respectively.

Since the start of the pandemic in 2020, global firms have borrowed heavily in debt markets, with weaker ones raising money for survival, while the stronger issued debt to fund consolidation and M&A activities.

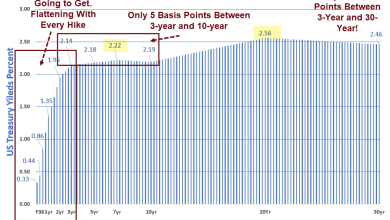

However, this year’s rise in bond yields driven by expectations of Fed tightening has raised borrowing costs.

The yield indicated on the ICE BofA U.S. corporate index (.MERC0A0), which tracks dollar denominated investment grade rated corporate debt, rose to 3.1% on Wednesday, compared with 2.34% at the end of 2021.

Meanwhile, global companies’ massive cash piles are also seen as another reason for lower bond issuance this year.

“With roughly $3 trillion of cash and short-term securities on their balance sheets, non-financials have room to manoeuver without as much reliance on debt issuance,” Nick Kraemer, head of S&P Global Ratings Performance Analytics, said in a report.

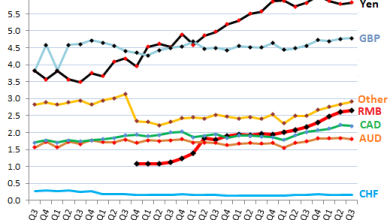

He also said Chinese issuers’ deleveraging efforts would have a negative effect on global corporate debt borrowing this year.

Chinese issuers account for roughly 24% of global non-financial and financial service issuance, according to the S&P Global data.

Joe Brusuelas, chief economist at consulting firm RSM, said the lower debt issuance will have a cooling impact on economies as corporations slow expansion plans.

“We expect that this will be evident in the second half of the year in general and the final quarter of 2022 in particular,” Brusuelas said.

Register now for FREE unlimited access to Reuters.com

Register

Reporting by Patturaja Murugaboopathy; Additional reporting by Gaurav Dogra in Bengaluru; Editing by Vidya Ranganathan and David Holmes

Our Standards: The Thomson Reuters Trust Principles.

Source link