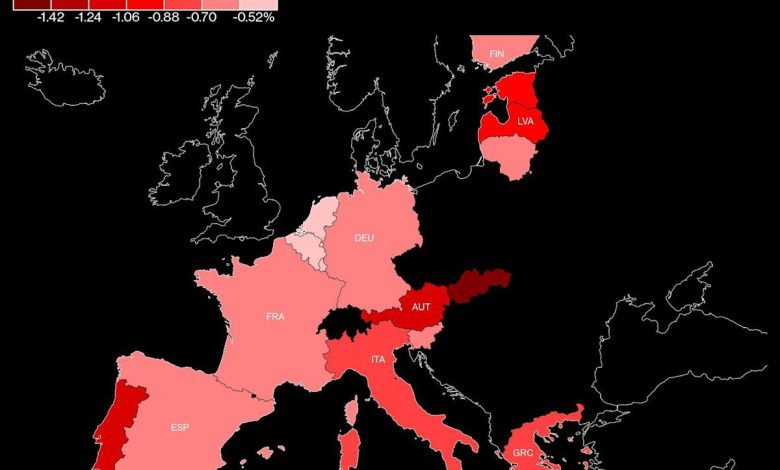

Europe’s Inflation Challenge Amplified as Energy Prices Soar

(Bloomberg) —

Most Read from Bloomberg

Central banks in Europe may have to reassess plans for tighter monetary policy after global energy prices jumped following Russia’s invasion of Ukraine, even as the spike worsens the inflation outlook.

The dramatic developments on Thursday ripped through markets, pushing commodity prices higher and sending oil above $105 a barrel for the first time since 2014. But those moves came alongside fresh economic growth concerns that sent global stocks plunging and drew demand for haven assets such as U.S. Treasuries and German government bonds.

Those combined market dynamics capture the difficult trade-off central banks now face as they seek to strike a balance between curbing inflation and making sure those efforts don’t choke off economic growth.

The dilemma will heighten the debate at the Bank of England the European Central Bank officials when they hold their respective policy meetings next month. Robert Holzmann, one of the ECB’s most hawkish officials, admitted Thursday that the invasion could slow its stimulus exit.

“It’s clear that we’re moving toward normalizing monetary policy,” he told Bloomberg in an interview. “It’s possible however that the speed may now be somewhat delayed.”

The BOE has already started hiking interest rates, with another move expected next month. The ECB may press on with plans to end bond buying, but will have to decide if it wants to push back against market speculation about a euro-zone rate increase this year.

Traders are still fully pricing a 25-basis-point BOE hike in March, though pared hedges for a larger half-point increase. Investors are wagering about 40 basis points of ECB tightening by the end of the year compared with 45 basis points Wednesday.

Both central banks will “tread more carefully at their March meetings,” according to Holger Schmieding, chief economist at Berenberg Bank.

ECB policy makers are holding a pre-scheduled informal gathering in Paris on Thursday. On the eve of the meeting, Governing Council member Gabriel Makhlouf said the crisis over Ukraine won’t keep the central bank from agreeing on a faster wind-down of asset purchases in March, though the prospects for a rate hike are less clear.

Just a day ago, BOE Governor Andrew Bailey warned that an escalation in Ukraine crisis would push inflation higher.

Such risks are now becoming reality. In addition to oil and gas, food prices are also surging. That’s being driven by news that commodity exports from Ukraine, one of the world’s most important grain suppliers, has been thrown into chaos by port and railway closures in the country.

Not Inflationary

But there’s also a growth threat as the Russia attack threatens business and consumer confidence, and higher prices worsen a cost-of-living crisis and create demand destruction.

Shamik Dhar, chief economist at BNY Mellon Investment Management and a former BOE economist, said central banks are likely to treat sharp rises in energy and commodity prices “as a disinflationary shock not an inflationary one that would tend to shift them to the dovish end of the spectrum.”

Bloomberg Economics looked at the possible impact on central banks via three scenarios. Under a limited attack, Europe and the U.S. would face higher energy prices, but the path for interest rates wouldn’t be affected. If there’s a full-scale invasion with punishing sanctions on Russia and gas flows cut off, the economic impact would be far worse, including a recession in the euro area.

Schmieding’s view is that the impact will be “short-lived,” with inflation staying “slightly more elevated” in Europe for the rest of the year and the recovery suffering a short setback but getting “back on track” afterward.

The chance of a severe downturn is also limited because recent history shows central banks have a tendency to rush to action to support growth in a crisis.

Growth Shock

“For a recession you’d need to see a major bear market sell-off and central banks not responding in the way they have in the recent past,” Dhar said. “You’d have to see the bond markets doing the opposite of what they have done before, and drive borrowing costs up.”

Still, the deterioration in the geopolitical situation will ripple through economies, affecting businesses and households and how they invest and spend.

“This is coming at a very bad time for markets,” Christian Mueller-Glissmann, a strategist at Goldman Sachs Group Inc., said on Bloomberg Television. “The market has really tried to establish a growth narrative because the only way risky assets can make progress if you have central banks tightening policy aggressively is if you have a good growth narrative. Now you are dealing with a growth shock, particularly for Europe.”

(Updates with ECB’s Holzmann in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link