Purchasing Power of the Dollar Goes WHOOSH!

Worst inflation in 40 years is spreading deeper into the economy.

By Wolf Richter for WOLF STREET.

The broadest Consumer Price Index (CPI-U) jumped by 0.5% in December from November, and by 7.04% from a year ago, the highest since June 1982, according to data released by the Bureau of Labor Statistics today.

But there’s a big difference between now and 1982. Now, the inflation index is spiking, and has been getting worse month after month; back in 1982, inflation was coming down. The last time inflation actually spiked like this on the way up and broke through the 7%-mark was in June 1978:

By a narrower measure, the Consumer Price Index for All Urban Wage Earners and Clerical Workers (CPI-W), the index used for Social Security COLAs, spiked by 7.8%, the worst since January 1982.

Inflation without food and energy – tracked by the “core” CPI – spiked by 5.5%, the most since February 1991. Food and energy prices can move with the volatile prices of the underlying commodities, and there have been some big surges among those commodities. But this “core” CPI shows how deep inflation has moved into the economy beyond prices that depend on volatile commodities.

And here is Fed Chair Jerome Powell’s reaction to today’s inflation WOOSH, as captured by cartoonist Marco Ricolli for WOLF STREET:

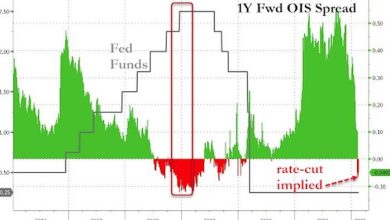

But so far, the Fed has refused to deal with this inflation. It is still repressing short-term interest rates to near 0%, and it’s still printing money in large amounts, though less than it did two months ago.

The effective federal funds rate (EFFR), which the Fed targets with its interest rate policy, is now at 0.08%. With CPI-U inflation at 7.04%, the inflation-adjusted or “real” EFFR is a negative 6.96%, the most negative “real” EFFR in the data going back to 1954, the hallmark of the most reckless Fed ever.

The purchasing power of the consumer’s dollar dropped further – that’s what inflation in consumer prices means. Inflation is the loss of the purchasing power of the dollar and everything denominated in dollars, such as wages and salaries. By December 2021, the purchasing power of $100 in January 2000 dwindled to $60.60:

Rent Factors, nearly one-third of CPI, started to jump.

The CPI contains two measures of rent that account for 32% of the CPI. These rent factors are the biggie. They dropped sharply in 2020 and early 2021, then U-turned in June and have been rising every month since, gradually picking up the increases in market rents. Because both measures are still below CPI, they’re still holding down CPI, but less than before.

“Rent of primary residence” (makes up 7.6% of overall CPI), rose by 3.3% year-over-year but remains below where it had been before the pandemic, as it is gradually pushed higher by the surge in market rents (red in the chart below).

“Owner’s equivalent rent of residences” (makes up 23.5% of overall CPI), the stand-in for the costs of homeownership, is based on surveys that ask homeowners to estimate what their home might rent for. It rose 3.8% year-over-year (green line).

The two indices are now picking up the surges in market rents that started many months ago. Together, they account for nearly 1/3 of CPI, and while they’re still pushing down CPI, they’re pushing down less.

Given the surge in market rents last year that are now gradually filtering into these indices, we can see what direction they’re going this year, providing upward pressure on CPI.

The actual costs of buying a home spiked in 2021 by around 20%, according to the Case-Shiller Home Price Index, depicted in my series, The Most Splendid Housing Bubbles in America. This price spike leaves in the dust the “Owner’s equivalent of rent,” the stand-in for the costs of homeownership. Both, the Case-Shiller index (purple) and the “Owner’s equivalent of rent” (red) are set to 100 for January 2000:

Food costs (14% of overall CPI) jumped 6.3% year-over-year. The sub-index for “beef and veal” jumped by 18.6%. OK, switch to pork, which jumped by 15.1%. OK, switch to chicken, which jumped by 10.4%. OK, switch to “fresh fish and seafood,” which jumped “only” 10.2%, hahahaha. OK, forget it, switch to lentils….

Energy costs (7.5% of overall CPI) spiked by 29.3% year-over-year:

- Gasoline +49.6% year-over-year

- Utility natural gas to the home: +24.1% year-over-year

- Electricity service: +10.4% year-over-year.

The CPI for used cars and trucks (3.4% in overall CPI) jumped by 37.3% year-over-year. And it’s still going to get worse over the next month or two because wholesale prices, which lead the CPI by about two months, spiked majestically over the past three months, and are up 47% year-over-year, and the December CPI just picked up a portion of the spike (chart shows index value, not % change):

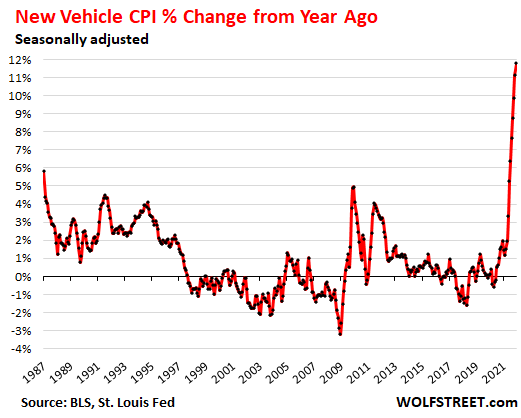

The CPI for new cars and trucks (3.9% in overall CPI) spiked by 11.8% year-over-year, the highest since 1975, and just below the two historic records set in 1975, as dealers have been selling new vehicles with addendum stickers of $2,000 or even $10,000 or more on top of MSRP. And consumers are paying no matter what as price resistance has completely fallen apart (chart shows the year-over-year % change):

Surely someday, the ridiculous price increases of new and used vehicles will back off. Spikes like this cannot continue spiking like this. But then other prices are spiking, including in services, and we can already see the rent factors, which account for one-third of CPI, pulling up to provide oomph in 2022. And they have nothing to do with the semiconductor shortages.

This is what inflation looks like when price resistance among consumers and businesses has collapsed, allowing companies to raise prices without losing customers, and thereby allowing inflation to spiral higher. Inflation is in part a psychological phenomenon. The inflationary mindset set in last year for the first time in decades. Why it has set in isn’t hard to pin down: The world is awash in newly created money, and it’s circulating, and enough people got enough of it through stimulus and asset price bubbles and cheap loans that they’re paying whatever and don’t even care anymore. And the most reckless Fed ever is still fueling this raging inflation.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Classic Metal Roofing Systems, our sponsor, manufactures beautiful metal shingles:

- A variety of resin-based finishes & colors

- Deep grooves for a high-end natural look

- Maintenance free – will not rust, crack, or rot

- Resists streaking and staining

To reach the Classic Metal Roofing folks, click here or call 1-800-543-8938

Source link