Paring Gains Despite a Big Rally Above 116

- Despite the rise in US Treasury bond yields, USDJPY is not a five-year high.

- Federal Reserve Minutes from December set the interest rate cap.

- Tokyo’s consumer price index cannot dispel the Bank of Japan’s concerns about deflation.

- Despite the low yields on US Treasury bonds, wages in the US remained weak in December.

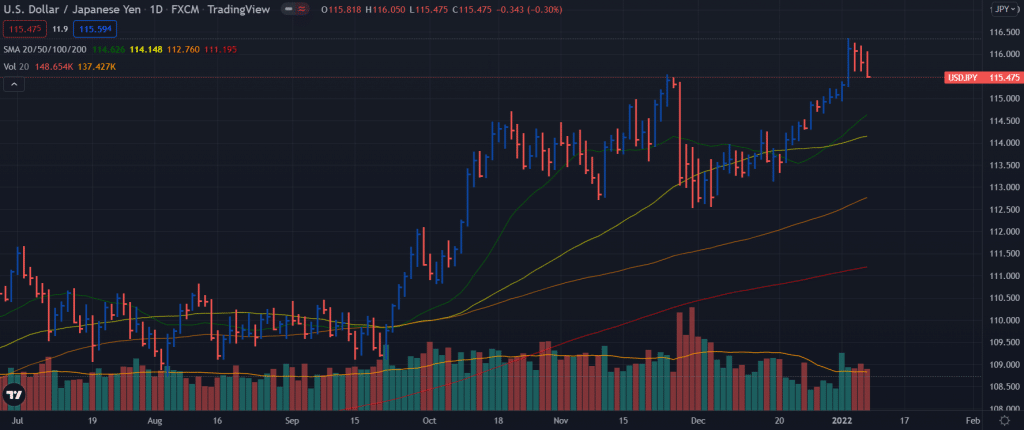

The USD/JPY weekly forecast is slightly bearish as the price declined around 90 pips from the top as the US dollar lost traction. Despite closing above the 116.00 level for the first time in five years, US Treasuries failed to maintain USDJPY above that level on Wednesday and Thursday.

–Are you interested to learn more about AI trading brokers? Check our detailed guide-

Nonfarm Payrolls (NFP) data were disappointing for the second month in a row. A total of 199,000 jobs were created in December, less than half of the forecast 400,000. In November, the revised 239,000 or 29,000 did not affect the remarkably weak labor market. In the last nine months, unfilled positions in JOLTS have reached a record high. As employers try to persuade workers to return to the workplace, hourly wages rose 4.7% in December and 5.1% in November.

Treasury yields rose along the yield curve. For example, the week following the close of trading on December 31, the 10-year bond yield rose 25 basis points to 1.76% from 1.512%.

According to the Federal Reserve System’s meeting minutes on December 16, the bank’s balance sheet was reduced by $8.5 billion. It was seen as another sign that managers are sticking to their new inflationary policies.

The annual inflation rate in Tokyo was 0.8% in December, but the core consumer price index (CPI) was unchanged at -0.3%. Hence, the Bank of Japan had no reason to change its ultra-adaptive monetary policy rate of -0.1%. In November, total household expenditure decreased by 1.3%, more than double the decline of 0.6% in October. Forecasts predict an increase of 1.6%. In November, earnings from work were flat, missing the 0.5% forecast after rising 0.2% in October.

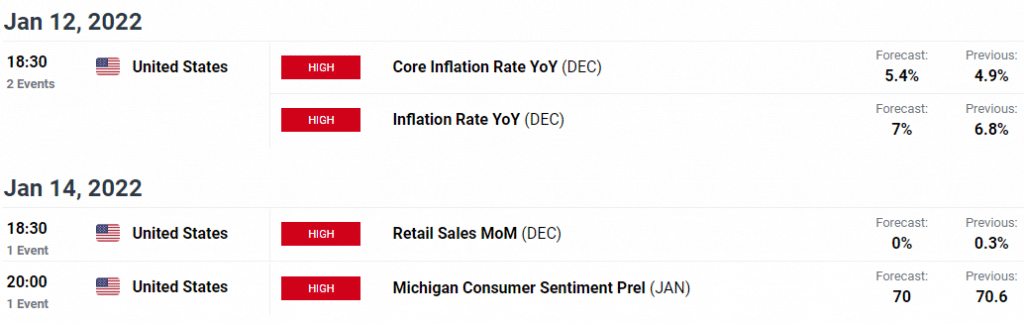

Key data/events for the USD/JPY

Key data for the Consumer Price Index in the US are the producer price index (PPI) and retail sales for December and consumer sentiment for Michigan in January. Sales data offer the best chance of influencing the market. When consumer prices fall below the forecast 0.3%, especially when the CPI is high, it increases the likelihood of stagflation, a 1970s term for high inflation when economic growth is slow. According to the Atlanta Fed, in the fourth quarter, the US economy grew 7.4% y/y, which could be enough to weaken the US dollar.

–Are you interested to learn more about Canada forex brokers? Check our detailed guide-

USD/JPY weekly technical forecast: Downside limited by 115.00

The USD/JPY price is retreating after posting highs above 116.00. However, the price has not yet breached the lows of the widespread up bar. Although the bias is negative for the pair, it is likely to see a pause in the downfall somewhere around the 115.00 area. The next support comes at 114.65 which is a 20-day SMA. On the upside, 116.00 will be the key hurdle to overcome ahead of 116.50. However, the pair needs huge buying volume to overcome this hurdle.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source link