Gold Set for Weekly Gain With Inflation Outlook, Dollar in Focus

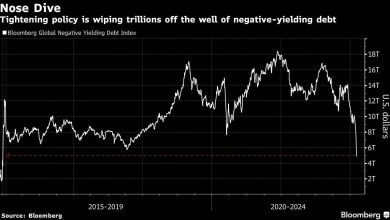

(Bloomberg) — Gold headed for a weekly advance, even as an advance in inflation-adjusted bond yields diminishes the appeal of the non-interest bearing asset.

Most Read from Bloomberg

Bullion is fluctuating near a key resistance level of about $1,835 an ounce, after a decline in nominal bond yields from a two-year high helped gold advance earlier in the week. On Friday, the metal was being pulled around by a drop in market-based measures of inflation that raises the real return of Treasuries, and by a weaker dollar that is supportive of gold.

The moves in the bond market come ahead of a widely anticipated meeting by the Federal Reserve next week. Officials have already raised the prospect of multiple rate hikes this year to curb inflation, which in December was the hottest in 40 years. U.S. Treasury Secretary Janet Yellen said Thursday she continues to forecast inflation falling close to 2% by the end of 2022.

Gold has managed to hold steady in 2022 even as central banks turn more hawkish. Volatility in the stock market has helped spur demand for the haven, with the S&P 500 on course for its worst week in almost 15 months. Geopolitical tensions between the U.S. and Russia may also be providing support.

“We still expect broad U.S. dollar strength, moderating inflation, and rising real yields to weigh on gold over the course of 2022, dragging its price down to $1,650 an ounce by year-end,” analysts at UBS Group AG wrote in a note.

Spot gold was little changed at $1,838.80 an ounce by 1:30 p.m. in London, on track for a 1.2% gain this week. The Bloomberg Dollar Spot Index erased gains made in the previous session. Silver steadied, platinum declined and palladium gained.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link