Tips to do Fundamental analysis of gold?

Fundamental analysis is an approach to evaluating the intrinsic value of an asset by analyzing its underlying economic and financial factors. It is an essential tool for traders and investors who are looking to make informed decisions about buying or selling assets. When it comes to gold, fundamental analysis involves assessing various economic and market factors that impact the price of the precious metal.

Factors Affecting the Price of Gold:

- Global economic conditions: The performance of the global economy has a significant impact on the demand for gold. During periods of economic uncertainty or recession, investors tend to buy gold as a safe-haven asset, which drives up the price of gold.

- Inflation: Inflation refers to the general rise in the prices of goods and services over time. When inflation is high, the value of paper money decreases, which tends to drive up the demand for gold. Gold is often considered a hedge against inflation.

- US dollar: Gold is priced in US dollars, so the value of the US dollar affects the price of gold. When the US dollar strengthens, the price of gold typically falls, and vice versa.

- Central bank policies: The policies of central banks can have a significant impact on the price of gold. For instance, if a central bank buys a significant amount of gold, it can drive up the price of the precious metal.

- Political and geopolitical events: Political and geopolitical events, such as elections, wars, and social unrest, can also impact the price of gold. During times of political instability, investors may turn to gold as a safe-haven asset, which can drive up the price of the precious metal.

Gold is one of the most valuable commodities and has been used as a store of value for centuries. Therefore, it is important to understand how to perform fundamental analysis on gold to help make informed decisions when trading.

Here are the steps to follow when performing fundamental analysis on gold:

- Supply and Demand: Understand the basic principles of supply and demand for gold. Gold is a limited resource, and the cost of production can be high. Therefore, the price of gold is determined by supply and demand. When demand exceeds supply, prices rise, and when supply exceeds demand, prices fall. Some factors that affect the demand for gold include geopolitical events, economic data releases, and the performance of the US dollar.

- Interest Rates: Interest rates also play a significant role in the price of gold. In general, gold prices tend to rise when interest rates are low, and fall when interest rates are high. This is because gold is often seen as a hedge against inflation, and when interest rates are low, investors tend to flock to gold as a way to preserve their wealth.

- Inflation: Inflation is another important factor to consider when analyzing gold. When inflation is high, the price of gold tends to rise. This is because gold is often seen as a hedge against inflation, and investors tend to flock to gold as a way to preserve their purchasing power.

- Currency: The performance of the US dollar can also impact the price of gold. When the US dollar is strong, the price of gold tends to fall, and when the US dollar is weak, the price of gold tends to rise. This is because gold is priced in US dollars, and a weak US dollar makes gold more affordable for investors holding other currencies.

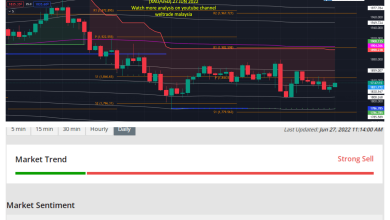

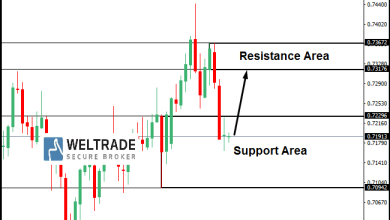

- Technical Analysis: In addition to the above factors, technical analysis can also be used to analyze gold prices. Technical analysis involves the use of charts and technical indicators to help predict future price movements.

Some websites and resources that can be used to perform fundamental analysis on gold include:

- Kitco.com: This website provides up-to-date gold prices, news, and analysis.

- Bloomberg.com: This website offers a wide range of financial news and data, including gold prices and analysis.

- World Gold Council: This is a leading authority on gold, providing analysis, research, and data on the gold market.

- Investopedia.com: This website offers a wide range of educational resources on investing, including articles on fundamental analysis of gold.

By analyzing the above factors, you can gain a better understanding of the gold market and make more informed trading decisions. It’s important to keep in mind that the gold market is complex and subject to a wide range of factors that can impact its price, so conducting a thorough analysis is essential.

In conclusion, fundamental analysis is an essential tool for evaluating the intrinsic value of gold. By analyzing various economic and market factors that impact the price of gold, traders and investors can make informed decisions about buying or selling the precious metal. As with any asset, a comprehensive analysis should include both fundamental and technical analysis, as well as other factors that may impact the price of gold.

Can join at our telegram group at Education and Signal , https://t.me/+NfCxZrhbyZIzMGI1 to have good signals and education.

Join us at our zoom link, https://us06web.zoom.us/j/87503803695?pwd=UGxmeGpDc3BvK3JFK1NrRjlJQzVldz09 for online learning from 11.30 am to 12.30 am, from Monday to Friday by the Financial Markets Research Center (FMRC) team, with Head of Financial Education, Training and Capability Development , Mr. Gurmit Singh.

Komen anda

Source link