Gold steadies with focus on Ukraine, Fed rate hike moves

Jan 24 (Reuters) – Gold prices steadied on Monday as tensions over Ukraine buoyed its safe-haven allure, while investors held off on big moves ahead of a Federal Reserve meeting this week that could provide clues on the U.S. central bank’s interest rate trajectory.

Spot gold was little changed at $1,832.60 per ounce by 10:10 a.m. EST (1510 GMT). U.S. gold futures rose 0.1% to $1,833.10.

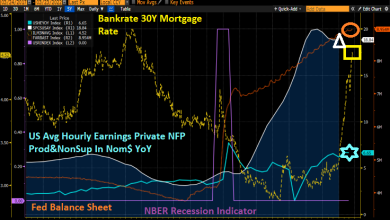

At its two-day meeting starting on Tuesday, the Fed is expected to announce that it will tighten monetary policy at a much faster pace than thought previously to tame persistently high inflation. read more

Register now for FREE unlimited access to Reuters.com

Register

“The Ukraine story is positive for gold and the Fed policy will eventually evolve into a little bit more conservative tapering since the Fed still believes a lot of this is going to be transitory,” said Ed Moya, senior market analyst at brokerage OANDA.

While gold is considered a hedge against inflation and geopolitical risks, interest rate hikes would raise the opportunity cost of holding non-yielding bullion.

NATO said it was putting forces on standby in eastern Europe in response to Russia’s military build-up at Ukraine’s borders, adding to signals the West is bracing for an aggressive Russian move against the Eastern European country. Moscow has denied any plan to invade. read more

These concerns hit risk appetite, buoying safe havens.

Eventually, gold will become a key holding for a lot of investors as they look for protection as growth concerns become more elevated and as the outlook becomes more uncertain going forward, Moya noted, adding “gold could trade between $1,800-$1,860, or even a little higher in the next couple of weeks.”

Gold was also fairly resilient against a rising dollar, a rival safe haven, which makes bullion more expensive for overseas buyers. (.DXY).

Spot silver dropped 2.7% to $23.58 an ounce, platinum slipped 2.3% to $1,005.09 and palladium eased 0.2% to $2,104.02.

Register now for FREE unlimited access to Reuters.com

Register

Reporting by Kavya Guduru in Bengaluru

Editing by Paul Simao

Our Standards: The Thomson Reuters Trust Principles.

Source link